It isn't the 47% about whom Romney doesn't care; he really only cares about the 1%, maybe on a good day the 2% at the top, and those corporation 'people'.

There is a reason that Romney isn't running on his record as Governor of Massachusetts. That reason is that as an executive in the government sector, he was terrible. Mitts on R-money is good at one thing and one thing only - extracting wealth for the benefit of the 1%.

Skeptical? It's good to be skeptical, but the numbers don't lie.

I was going to try to find the graphs from this video clip to post separately, but they're well put together here, and you might as well see them together in this order. The last graph, the one which shows the recovery of wealth, the increase in the wealth gap that has favored the wealthy disproportionately, is the most telling. The wealthier you are, the faster the rate at which wealth was redistributed to you.

As the first graph in the series in this video shows, it is not that the 99% have not been working hard, been productive, done all of the things which previously in this country would have made them successful instead of losing ground and losing their economic mobility. It is that the wealthy have been disproportionately overpaid without having the merit for that compensation of comparable productivity or executive excellence. They are overpaid in the corporate sector because compensation is controlled by interlocking boards of directors who control compensation that was previously under the control of the actual owners - the shareholders - of the businesses.

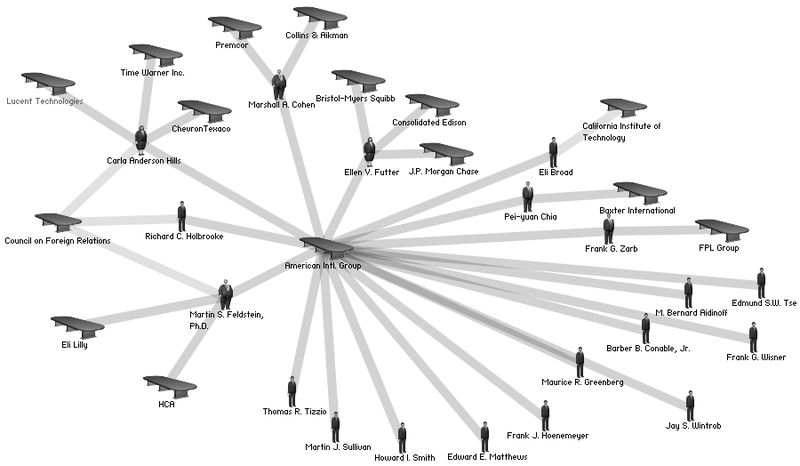

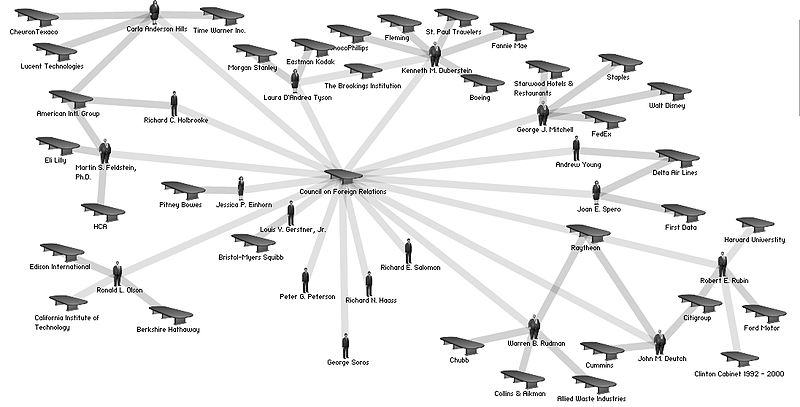

This means the problems of interlocking directorates is that it creates a quid pro quo, you scratch my back I'll scratch yours problem for board members and for those who are highly paid executives, sometimes referred to as the 'C-class' executives, as in Chief Executive Officer, Chief Financial Officer, etc. Short version - they pay each other high compensation packages, often disconnected from performance. It is a specific subset of crony capitalism. Here are visual representations of a few examples below:

There are multiple consequences of this kind of cronyism; not only does it lead to dramatically HUGE increases in executive compensation for those in the upper 1%, it also lends itself, between companies in the same areas of business to cooperate to keep wages artificially low, circumventing competition, and to a degree this is true as well of unrelated areas of business where the same pool of potential workers is involved. It lends itself to corruption, it lends itself to executives being paid rather than benefits going to shareholders who own the companies -- and that often includes lower ranking employees, in the form of individuals who have stock in retirement accounts or personal investments, either with shares in the specific company for which they work, or in affecting the value of shares in their investment accounts more generally, including IRAs, mutual funds, etc.

There are many, many means that transfer /redistribute wealth away from the 99% to the wealthy that are no the result of entrepreneurial initiative or creative genius or any other measure of merit. Merit should be rewarded -- but that also includes the exceptional rate of productivity of our labor force, which has NOT been proportionately or equitably compensated, and THAT is the problem with the increasing CHASM of wealth and income inequality.

From the wikipedia entry, pay particular attention to the sections, my emphasis added in bold, that address these board members serving the interest of the 1%, and then think how closely this applies to Mitt Romney, and his statements about the 47% of 'takers' which encompasses both consumers AND labor, versus his 1% he characterizes as 'makers':

According to some observers (John Asimakopoulos), interlocks allow for cohesion, coordinated action, and unified political-economic power of corporate executives.[3] They allow corporations to increase their influence by exerting power as a group, and to work together towards common goals.[4] They help corporate executives maintain an advantage, and gain more power over workers and consumers, by reducing intra-class competition and increasing cooperation.[2][5] In the words of Scott R. Bowman, interlocks "facilitate a community of interest among the elite of the corporate world that supplants the competitive and socially divisive ethos of an earlier stage of capitalism with an ethic of cooperation and a sense of shared values and goals."[6]

Interlocks act as communication channels, enabling information to be shared between boards via multiple directors who have access to inside information for multiple companies.[1] The system of interlocks forms what Michael Useem calls a "transcorporate network, overarching all sectors of business".[7] Interlocks have benefits over trusts, cartels, and other monopolistic/oligopolistic forms of organization, due to their greater fluidity, and lower visibility (making them less open to public scrutiny).[4] They also benefit the involved companies, due to reduced competition, increased information availability for directors, and increased prestige.[2][8]

Some theorists believe that because multiple directors often have interests in firms in different industries, they are more likely to think in terms of general corporate class interests, rather than simply the narrow interests of individual corporations.[6][9][10] Also, these individuals tend to come from wealthy backgrounds, socialize with the upper classes,[6]

Furthermore, multiple directors tend to be more frequently appointed to government positions, and sit on more non-profit/foundation boards than other directors. Thus, these individuals (known as the "inner circle" of the corporate class) tend to contribute disproportionately to the policy-planning and government groups that represent the interests of the corporate class,[11][12] and are the ones that are most likely to deal with general policy issues and handle political problems for the business class as a whole.[13] These individuals and the people around them are often considered to be the "ruling class" in modern politics.[3] However, they do not wield absolute power, and they are not monolithic, often differing on which policies will best serve the interests of the upper classes.[14]

Interlocks not only occur between corporations, but also between corporations and non-profit institutions such as foundations, think tanks, policy-planning groups, and universities.[15][16] They can also be seen as a subset of connections in a larger upper class social network which includes all of the aforementioned types of institutions as well as elite social clubs, schools, resorts, and gatherings.[3][17] Multiple directors are "roughly twice as likely as single directors to be in the Social Register, to have attended a prestigious private school, or to belong to an elite social club."[18]

Modern interlock networks

Analyses of corporate interlocks have found a high degree of interconnectedness amongst large corporations.[19][20] It has also been shown that in-bound interlocks (i.e. a network link from external firms into a focal firm) are far more impactful that out-bound interlocks, a finding that laid the foundation for further research on inter-organizational networks based on overlapping memberships and other linkages such as joint ventures and patent backward and forward citations.[21] Virtually all large U.S. corporations are linked together in a network of interlocks.[22] Most corporations are within 3 or 4 "steps" from each other within this network.[19] Approximately 15-20% of all directors sit on two or more boards.[11] The largest corporations tend to have the most interlocks, and also tend to have interlocks with each other, placing them at the center of the network.[23] Major banks, in particular, tend to be at the center of the network and have large numbers of interlocks.[24][25] With the globalization of financial capital following World War II, multinational interlocks have become progressively more common.[26]

Legality

In the United States, the Clayton Act prohibits interlocking directorates by U.S. companies competing in the same industry, if those corporations would violate antitrust laws if combined into a single corporation. However, at least 1 in 8 of the interlocks in the United States are between corporations that are supposedly competitors.[29]

With that in mind, when Mitts on R-money talks about employing those in the 99% he and his wife think of as 'you people'......do you really think he is contemplating increasing YOUR compensation, with jobs which pay good living wages? Or do you think he intends to continue the efforts of his cronies to disproportionately redistribute wealth to himself and his 'corporate class' 1%ers?

If you think voting for Romney would mean that he intends to give you the opportunity to become as wealthy as he is - think again. Romney stands for everything which creates an unequal and unfair ground for competition, Romney stands for everything which redistributes wealth to himself and his very small circle of wealthy people in that 1%. He doesn't want to let you in, not at all; he wants to keep you down, to make it easier to rip us all off, with fewer protections in the form of regulation to prevent us being defrauded as people were in the economic Bush era financial disaster, and to put fewer impediments to he and his cronies gouging anyone who is not them.

The 'Young Turks' is precisely on target in elaborating the nature of this chasm, this divide. It is not the 99% engaging in class warfare, it is the 99% who are victims of it. It is not the 99% who have created this chasm, it is the 99% who have been the victims of these unfair compensation and other disadvantages put in place by the 1% for their gain --- and gain they have.

The interlocking directorates are by no means the only way in which the 1% have increased the wealth and income disparity, there have been many ways, all of them carefully orchestrated, to achieve that over a period of time. But it is an excellent example of the very real class warfare under which the 99% are exploited and treated unfairly by a rigged system -- rigged by Romney and his crony capitalist political supporters.

Don't make it worse by voting for him, or any member of his party, or the subset, the extraordinarily gullible low-information voter Tea Party.

Cenk tells it like it really is.

There is a reason that Romney isn't running on his record as Governor of Massachusetts. That reason is that as an executive in the government sector, he was terrible. Mitts on R-money is good at one thing and one thing only - extracting wealth for the benefit of the 1%.

Skeptical? It's good to be skeptical, but the numbers don't lie.

I was going to try to find the graphs from this video clip to post separately, but they're well put together here, and you might as well see them together in this order. The last graph, the one which shows the recovery of wealth, the increase in the wealth gap that has favored the wealthy disproportionately, is the most telling. The wealthier you are, the faster the rate at which wealth was redistributed to you.

As the first graph in the series in this video shows, it is not that the 99% have not been working hard, been productive, done all of the things which previously in this country would have made them successful instead of losing ground and losing their economic mobility. It is that the wealthy have been disproportionately overpaid without having the merit for that compensation of comparable productivity or executive excellence. They are overpaid in the corporate sector because compensation is controlled by interlocking boards of directors who control compensation that was previously under the control of the actual owners - the shareholders - of the businesses.

This means the problems of interlocking directorates is that it creates a quid pro quo, you scratch my back I'll scratch yours problem for board members and for those who are highly paid executives, sometimes referred to as the 'C-class' executives, as in Chief Executive Officer, Chief Financial Officer, etc. Short version - they pay each other high compensation packages, often disconnected from performance. It is a specific subset of crony capitalism. Here are visual representations of a few examples below:

|

| Network diagram showing interlocks between various U.S. corporations/institutions, and four major media/telecom corporations (circled in red). |

|

| Network diagram showing interlocks of the board members of American International Group (AIG), from 2004 with other U.S. corporations. |

|

| Network diagram showing interlocks between various U.S. corporations and institutions and the Council on Foreign Relations, in 2004 |

There are many, many means that transfer /redistribute wealth away from the 99% to the wealthy that are no the result of entrepreneurial initiative or creative genius or any other measure of merit. Merit should be rewarded -- but that also includes the exceptional rate of productivity of our labor force, which has NOT been proportionately or equitably compensated, and THAT is the problem with the increasing CHASM of wealth and income inequality.

From the wikipedia entry, pay particular attention to the sections, my emphasis added in bold, that address these board members serving the interest of the 1%, and then think how closely this applies to Mitt Romney, and his statements about the 47% of 'takers' which encompasses both consumers AND labor, versus his 1% he characterizes as 'makers':

According to some observers (John Asimakopoulos), interlocks allow for cohesion, coordinated action, and unified political-economic power of corporate executives.[3] They allow corporations to increase their influence by exerting power as a group, and to work together towards common goals.[4] They help corporate executives maintain an advantage, and gain more power over workers and consumers, by reducing intra-class competition and increasing cooperation.[2][5] In the words of Scott R. Bowman, interlocks "facilitate a community of interest among the elite of the corporate world that supplants the competitive and socially divisive ethos of an earlier stage of capitalism with an ethic of cooperation and a sense of shared values and goals."[6]

Interlocks act as communication channels, enabling information to be shared between boards via multiple directors who have access to inside information for multiple companies.[1] The system of interlocks forms what Michael Useem calls a "transcorporate network, overarching all sectors of business".[7] Interlocks have benefits over trusts, cartels, and other monopolistic/oligopolistic forms of organization, due to their greater fluidity, and lower visibility (making them less open to public scrutiny).[4] They also benefit the involved companies, due to reduced competition, increased information availability for directors, and increased prestige.[2][8]

Some theorists believe that because multiple directors often have interests in firms in different industries, they are more likely to think in terms of general corporate class interests, rather than simply the narrow interests of individual corporations.[6][9][10] Also, these individuals tend to come from wealthy backgrounds, socialize with the upper classes,[6]

Furthermore, multiple directors tend to be more frequently appointed to government positions, and sit on more non-profit/foundation boards than other directors. Thus, these individuals (known as the "inner circle" of the corporate class) tend to contribute disproportionately to the policy-planning and government groups that represent the interests of the corporate class,[11][12] and are the ones that are most likely to deal with general policy issues and handle political problems for the business class as a whole.[13] These individuals and the people around them are often considered to be the "ruling class" in modern politics.[3] However, they do not wield absolute power, and they are not monolithic, often differing on which policies will best serve the interests of the upper classes.[14]

Interlocks not only occur between corporations, but also between corporations and non-profit institutions such as foundations, think tanks, policy-planning groups, and universities.[15][16] They can also be seen as a subset of connections in a larger upper class social network which includes all of the aforementioned types of institutions as well as elite social clubs, schools, resorts, and gatherings.[3][17] Multiple directors are "roughly twice as likely as single directors to be in the Social Register, to have attended a prestigious private school, or to belong to an elite social club."[18]

Modern interlock networks

Analyses of corporate interlocks have found a high degree of interconnectedness amongst large corporations.[19][20] It has also been shown that in-bound interlocks (i.e. a network link from external firms into a focal firm) are far more impactful that out-bound interlocks, a finding that laid the foundation for further research on inter-organizational networks based on overlapping memberships and other linkages such as joint ventures and patent backward and forward citations.[21] Virtually all large U.S. corporations are linked together in a network of interlocks.[22] Most corporations are within 3 or 4 "steps" from each other within this network.[19] Approximately 15-20% of all directors sit on two or more boards.[11] The largest corporations tend to have the most interlocks, and also tend to have interlocks with each other, placing them at the center of the network.[23] Major banks, in particular, tend to be at the center of the network and have large numbers of interlocks.[24][25] With the globalization of financial capital following World War II, multinational interlocks have become progressively more common.[26]

Legality

In the United States, the Clayton Act prohibits interlocking directorates by U.S. companies competing in the same industry, if those corporations would violate antitrust laws if combined into a single corporation. However, at least 1 in 8 of the interlocks in the United States are between corporations that are supposedly competitors.[29]

With that in mind, when Mitts on R-money talks about employing those in the 99% he and his wife think of as 'you people'......do you really think he is contemplating increasing YOUR compensation, with jobs which pay good living wages? Or do you think he intends to continue the efforts of his cronies to disproportionately redistribute wealth to himself and his 'corporate class' 1%ers?

If you think voting for Romney would mean that he intends to give you the opportunity to become as wealthy as he is - think again. Romney stands for everything which creates an unequal and unfair ground for competition, Romney stands for everything which redistributes wealth to himself and his very small circle of wealthy people in that 1%. He doesn't want to let you in, not at all; he wants to keep you down, to make it easier to rip us all off, with fewer protections in the form of regulation to prevent us being defrauded as people were in the economic Bush era financial disaster, and to put fewer impediments to he and his cronies gouging anyone who is not them.

The 'Young Turks' is precisely on target in elaborating the nature of this chasm, this divide. It is not the 99% engaging in class warfare, it is the 99% who are victims of it. It is not the 99% who have created this chasm, it is the 99% who have been the victims of these unfair compensation and other disadvantages put in place by the 1% for their gain --- and gain they have.

The interlocking directorates are by no means the only way in which the 1% have increased the wealth and income disparity, there have been many ways, all of them carefully orchestrated, to achieve that over a period of time. But it is an excellent example of the very real class warfare under which the 99% are exploited and treated unfairly by a rigged system -- rigged by Romney and his crony capitalist political supporters.

Don't make it worse by voting for him, or any member of his party, or the subset, the extraordinarily gullible low-information voter Tea Party.

Cenk tells it like it really is.

The basic idea of competition, or anti-trust, law is to prevent monopolies, yet despite strong anti-monopoly measures, they have been allowed to return from Hell. In fact, quite a few ideas which are contrary to "market capitalism" have been allowed to come into being due to "neo-con"/reactionary forces.

ReplyDeleteThe basic concept of a market allows for there to be buyers and sellers. But you need (1) people with jobs who have money for there to be buyers and (2) competition in the workplace for there to be proper sellers and a market (that is people competing to provide goods and services at the market rate. Skew that equation and there is no longer a market economy.

In fact, I would say that what exists in most "market economies" is worse than the command capitalism that comes out of China and neither of which are pure capitalism.

Microsoft is a perfect example of how monoploies are run by robber barons, Xerox PARC created a Graphical User Interface (GUI) called WIMP ("windows, icons, menus, pointer"), this system went on to found basis for other GUI systems such as Apple OS, Windows, and so on. Unfortunately, the person who created the WIMP GUI never sued to keep it in the public domain, which allowed for windows to eventually become a monopoly selling trashy software.

Of course, as we know, there are alternatives to windows out there, but most people are not. Also, quite a few software developers only make software for the windows platform.

But, as you point out, the people with the money can collude to place one into a position where they are stuck having to deal with a monopoly since the monopoly and similar interests control the marketplace.

In no way is that capitalism, or democratic.

Five stars, a blue ribbon and a standing ovation.

ReplyDeleteYou clearly know your stuff.

Thanks!